Over the last few years, the dichotomy of the real estate market has been pronounced. We’ve seen steady growth in median prices, drastically increased 30-year mortgage rates, and decreased days on market overall. Our Truckee and North Lake Tahoe regions, similar to many regions in California and across the greater U.S., are reflective of market dynamics that are continuously evolving.

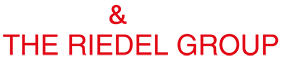

Interest Rates and Market Dynamics

The period from 2020 to the present has witnessed a significant shift in interest rates, impacting the real estate market in North Lake Tahoe and Truckee. In 2020, historically low interest rates stimulated buyer activity, resulting in heightened demand for single-family homes. As the market progressed into the following years, a sharp increase in interest rates has moderated buyer enthusiasm. While remaining relatively competitive, the higher rates have contributed to a more balanced market, aligning buyer demand with available inventory.

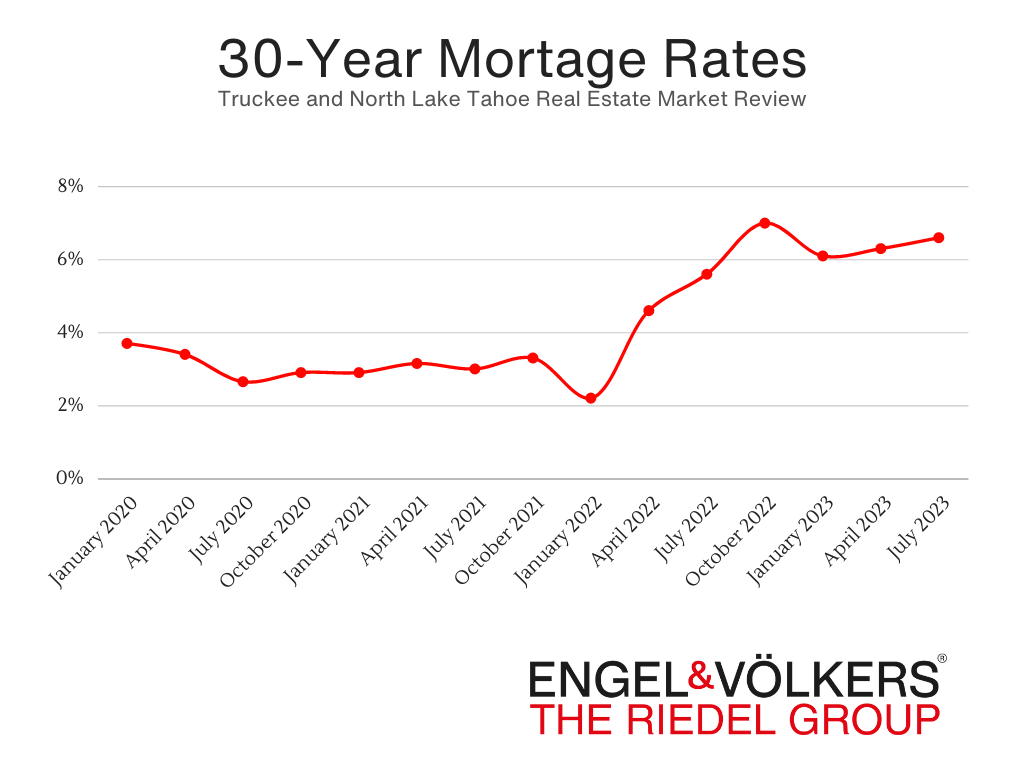

Days on Market (DOM) Trends

Over the past few years, a discernible transformation in Days on Market (DOM) metrics has characterized the North Lake Tahoe and Truckee single-family homes market. In 2020, homes tended to linger on the market for extended periods, partly attributed to uncertainties stemming from the pandemic. However, the trend has markedly shifted towards shorter DOM figures recently. Reduced DOM signifies a more fluid market, indicative of improved buyer-seller interactions and growing market confidence.

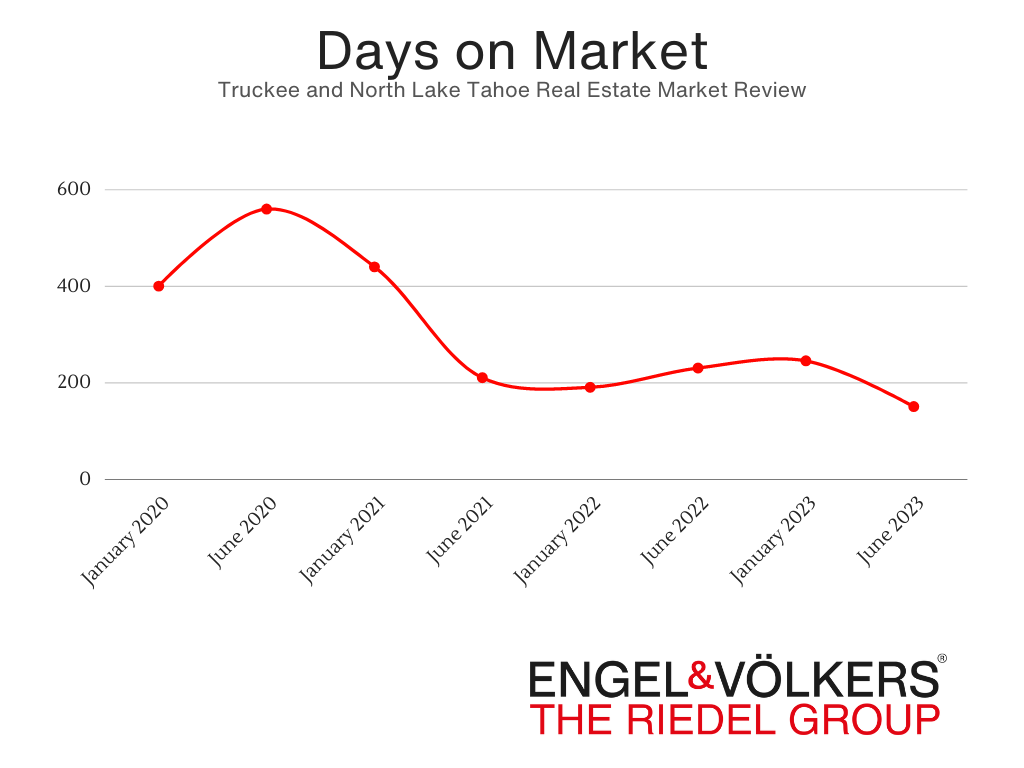

Median Price Fluctuations

The median price of single-family homes in North Lake Tahoe and Truckee has demonstrated a consistent upward trajectory, with an average increase of approximately 5.65% between 2020 and 2023. The interplay of demand, constrained inventory, and regional desirability has culminated in this steady appreciation. Despite the modest percentage growth, the cumulative effect over successive years substantiates the region’s resilience in sustaining property value growth.

Our real estate market has undergone discernible shifts from 2020 to the present. While the landscape has adapted to changing interest rates, the market has matured into a more balanced state. Reduced Days on Market reflect improved efficiency in property transactions, while the steady annual increase in median prices underscores the region’s enduring real estate value proposition. As the market evolves, these trends serve as vital indicators for buyers, sellers, and industry professionals navigating this dynamic landscape.